Click below link to download GDS Pay Committee Report : Download

GDS Pay Commission Report. Pay fixation details. Report contains 434 pages.

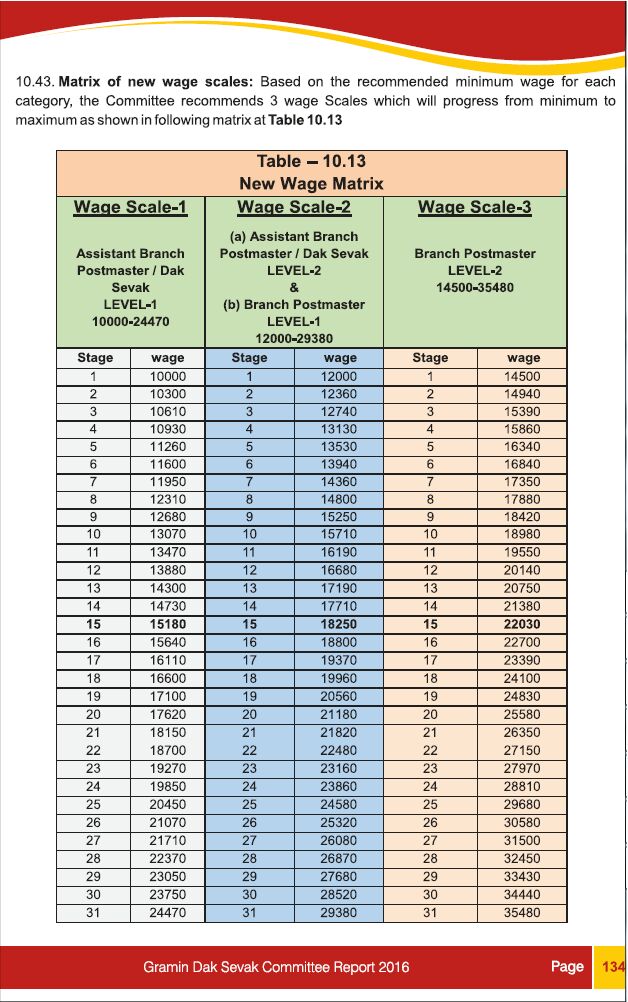

For 3 Hrs GDS work entry level pay was fixed as Rs.10000.

Ordinary Leave : 15 days in every Jan and Jul and accumulated upto 180 days.

Emergency Leave : 5 days in a year cannot carry over.

ML : 26 weeks

Paternity Leave : 7 days

For 3 Hrs GDS work entry level pay was fixed as Rs.10000.

Ordinary Leave : 15 days in every Jan and Jul and accumulated upto 180 days.

Emergency Leave : 5 days in a year cannot carry over.

ML : 26 weeks

Paternity Leave : 7 days

Dear GDS Friends, The kamalesh Chandra Committee report is not available in India Post websites till now.

Here is a fresh link please Click Here to check availability of GDS Committee report.